The traditional model of philanthropy created a wall of separation between the drive to make money and the desire to do good in the world. Investors would focus first and foremost on return on investment, make as much money as possible and then gift to charity.

Today, however, there are many opportunities to invest in companies that are advancing social and environmental causes while simultaneously seeking to generate competitive market returns. Asset growth is on the rise: Total U.S.-domiciled assets under management using sustainable, responsible and impact investing strategies grew from $12 trillion at the start of 2018 to $17.1 trillion at the start of 2020, an increase of 42% according to the U.S. SIF Forum for Sustainable and Responsible Investing. This represents 33% — or one in three dollars — of total U.S. assets under professional management.

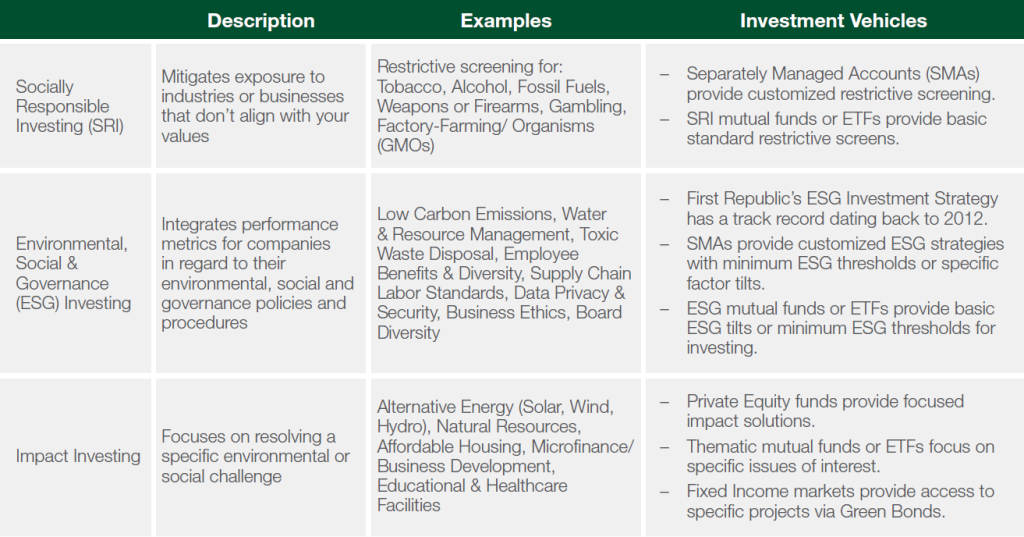

An introduction to three models: SRI, ESG and impact investing

Socially responsible investing (SRI) and environmental, social and governance (ESG) investing are two values-driven models firms have employed for years. With SRI, an exclusionary screening approach is applied to avoid investing in companies that sell items that may conflict with personal, moral or ethical values (think alcohol, tobacco, weapons and genetically modified foods).

On the other hand, ESG investing utilizes a positive screening approach, identifying best-in-class companies with strong environmental, social and governance policies. The largest ESG ratings agency, MSCI, covers over 8,500 publicly traded companies and issues an ESG score rating of AAA to CCC (similar to a bond rating). These reports evaluate companies on a range of ESG issues, including carbon footprint, water management, product life cycle, packaging, employee welfare, diversity, data privacy and security, and female board representation, to name a few.

Impact investment is a newer and, some may say, more direct values-driven model with the primary objective of solving a social or an environmental issue while concurrently generating a positive return. For example, an impact investor could choose to devote their funds directly to an alternative energy enterprise (wind or solar), an energy efficiency project, or natural and organic food production. Impact investing could also mean investing in affordable housing, medical or educational facilities in low-income areas, or resource management via municipal water infrastructure bonds.

Exploring investment options

Impact investing has traditionally been accessible through two asset types: private equity and/or bonds. Private equity affords the opportunity to invest directly in mission-focused social enterprises and small businesses as opposed to large public companies encompassing multiple departments, services or products. With private equity, impact investors can commit their capital to companies that are specifically focused on making a difference. However, private investments are often subject to investment minimums, and lock-up periods should be taken into consideration.

Bonds create an avenue to invest in a larger company or entity, such as municipalities, with specific projects that are earmarked for impact. For instance, the World Bank coined the term “green bonds” in 2008 when it began issuing debt earmarked for projects to mitigate climate change. To that end, green bonds include everything from investments in energy efficiency, water management and green building to technologies in waste management and agriculture for the purpose of reducing greenhouse gas emissions. By the same token, investors have the ability to access bond issuances by large public companies such as banks and real estate investment trusts (REITs) that have earmarked corporate debt issuances for solar energy or energy efficiency projects.

Compared to impact investing, SRI and ESG approaches provide a wider range of investment options. With hundreds of publicly traded mutual funds and exchange-traded funds (ETFs), these funds are available to investors of all sizes. ESG advocates argue that ESG data provides an additional layer of risk analysis for portfolio management, which could lead to better long-term performance.

Notable trends in the ESG space

For years, environmentalists have been calling for action from the private sector to address the global issue of climate change. Companies have started responding, in particular due to increased engagement from investors and recent climate-related disasters. There has been a significant rise in both shareholder filing and support for environmental issues, with over 115 proposals filed this year requesting sustainability reporting, two-degree scenario analysis or other climate change–related topics, according to corporate governance firm Institutional Shareholder Services. Climate change has evolved from just a “let’s care for our planet” issue to a material financial risk for investors.

Also of note this year is the issue of gender, racial and ethnic equality in the workplace and, more specifically, the corporate boardroom. The 2020 death of George Floyd and resulting outcry, including the Black Lives Matter movement prompted corporations to closely examine their inclusion of minorities in management and board positions. As a result, 130 Black board members were appointed to companies in the Russell 3000 in the five months following Floyd’s death, compared to just 38 new board members over the prior period, an increase of over 239%. In December 2020, Nasdaq filed a proposal with the U.S. Securities and Exchange Commission to require all listed companies to have at least one board member who identifies as female and at least one who identifies as a member of an underrepresented group.

Creating a portfolio that reflects your values

Any investor seeking a direct connection with how their capital is making a difference in the world is a great candidate for sustainable and responsible investing. Women and millennials in particular are currently driving demand for values-driven investments, but high net worth individuals, family foundations, donor-advised fund investors and institutional endowments are also participating.

If you’re interested in sustainable and responsible investing, it’s important to work with a wealth manager who’s knowledgeable about the field and can construct a portfolio that aligns with your values and focuses on optimizing your financial return. As with more traditional investments, you still need to consider the typical factors that affect your asset allocation mix, such as timeline for the funds, risk profile, and your overall goals and objectives.

Your wealth manager can help incorporate one or more of the investment styles below. For more information, reach out to your local wealth professional.