April 2023 Report:

Labor Quality Becomes Top Small Business Problem, Followed by Inflation

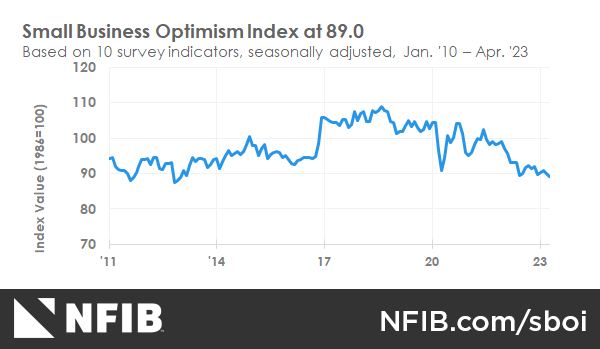

NFIB’s Small Business Optimism Index decreased by 1.1 points in April to 89.0. This marks the 16th consecutive month below the survey’s 49-year history of 98. Labor quality was the top business problem at 24%, with inflation in second place by one point at 23%.

“Optimism is not improving on Main Street as more owners struggle with finding qualified workers for their open positions,” said NFIB Chief Economist Bill Dunkelberg. “Inflation remains a top concern for small businesses but is showing signs of easing.”

Key findings include:

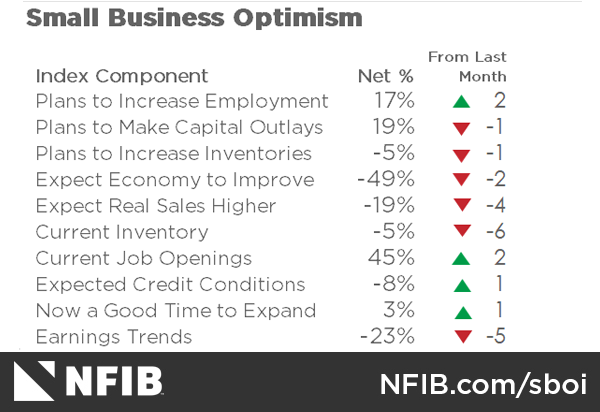

- The frequency of reports of positive profit trends was a net negative 23%, five points worse than March.

- A net negative 5% of owners viewed current inventory stocks as “too low” in April, down six points from March. This suggests stocks are now too large relative to expected sales.

- The net percent of owners raising average selling prices decreased four points to a net 33% (seasonally adjusted).

- The net percent of owners who expect real sales to be higher deteriorated four points from March to a net negative 19%.

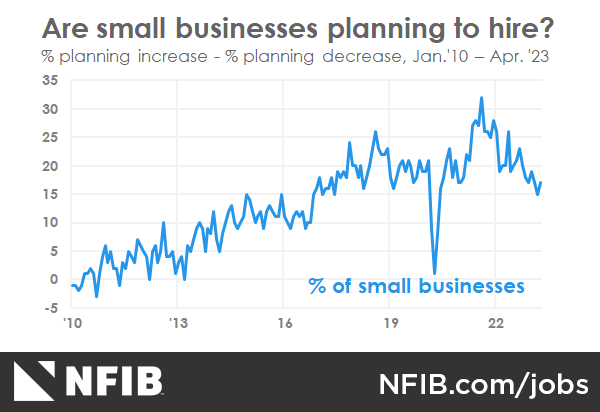

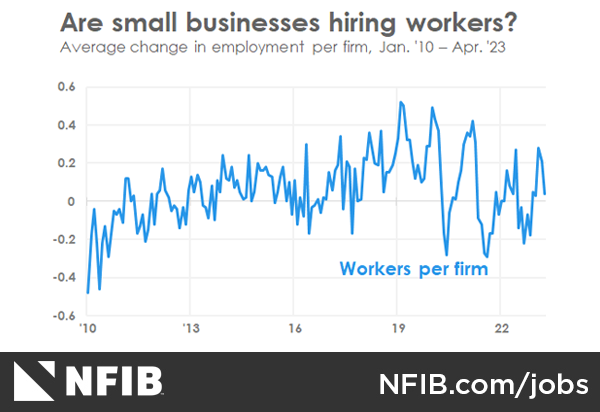

As reported in NFIB’s monthly jobs report, owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months. Seasonally adjusted, a net 40% reported raising compensation. A net 21% plan to raise compensation in the next three months. Nine percent cited labor costs as their top business problem and 24% said that labor quality was their top business problem.

Fifty-six percent of owners reported capital outlays in the last six months, down one point from March. Of those making expenditures, 40% reported spending on new equipment, 23% acquired vehicles, and 11% spent money on new fixtures and furniture. Fifteen percent improved or expanded facilities and 6% acquired new buildings or land for expansion. Nineteen percent of owners plan capital outlays in the next few months, down one point from March and historically very weak.

A net negative 9% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down three points. The net percent of owners expecting higher real sales volumes deteriorated four points to a net negative 19%.

The net percent of owners reporting inventory increases declined six points to a net negative 7%. Not seasonally adjusted, 13% reported increases in stocks and 19% reported reductions. Eighteen percent of owners recently reported that supply chain disruptions still have a significant impact on their business. Another 31% reported a moderate impact, and 37% reported a mild impact.

A net negative 5% of owners viewed current inventory stocks as “too low” in April, down six points from March. By industry, shortages are the most frequent in manufacturing (10%), agriculture (9%), retail (9%), and wholesale (8%). Shortages in construction (6%) have been reduced because home sales have slowed dramatically due to higher interest rates. A net negative 5% of owners plan inventory investment in the coming months, down one point from March.

The net percent of owners raising average selling prices decreased four points from March to a net 33% (seasonally adjusted), the lowest since March 2021. Unadjusted, 12% reported lower average selling prices and 48% reported higher average prices. Price hikes were the most frequent in construction (59% higher, 7% lower), retail (59% higher, 8% lower), wholesale (54% higher, 14% lower), and finance (52% higher, 5% lower). Seasonally adjusted, a net 21% plan price hikes.

The frequency of reports of positive profit trends was a net negative 23%, five points worse than in March. Among the owners reporting lower profits, 29% blamed weaker sales, 20% blamed the rise in the cost of materials, 13% cited the usual seasonal change, 10% cited labor costs, 9% cited lower prices, and 4% cited higher taxes or regulatory costs. For owners reporting higher profits, 51% credited sales volumes, 16% cited higher prices, 15% cited usual seasonal change, and 4% cited lower labor costs.

Two percent of owners reported that all their borrowing needs were not satisfied. Thirty percent of owners reported all credit needs were met and 59% said they were not interested in a loan. A net 6% reported their last loan was harder to get than in previous attempts, down three points. Four percent reported that financing was their top business problem. A net 26% of owners reported paying a higher rate on their most recent loan.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in April 2023.

Get The Full April Report (pdf)

LABOR MARKETS

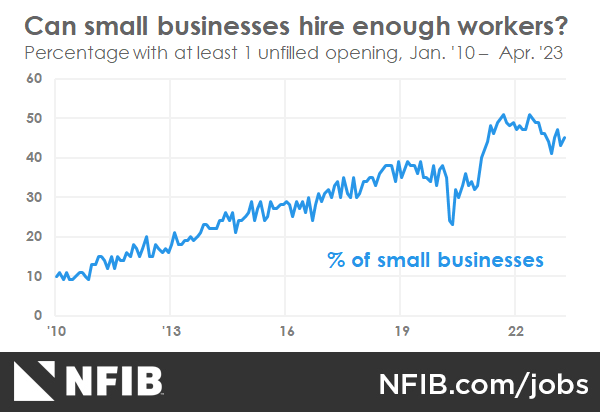

Forty-five percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up 2 points from March. Thirty-seven percent have openings for skilled workers (up 3 points) and 19 percent have openings for unskilled labor (unchanged). The difficulty in filling open positions is particularly acute in the construction, transportation, and manufacturing sectors. Openings are lowest in the finance sector. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17 percent planning to create new jobs in the next three months, up 2 points from March but 15 points below its record high reading of 32 reached in August 2021. Overall, 60 percent reported hiring or trying to hire in April, up 1 point from March. Fifty-five percent (92 percent of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (up 2 points). Twenty-nine percent of owners reported few qualified applicants for their open positions (up 3 points) and 26 percent reported none (down 1 point).

CAPITAL SPENDING

Fifty-six percent reported capital outlays in the last six months, down 1 point from March. Of those making expenditures, 40 percent reported spending on new equipment (unchanged), 23 percent acquired vehicles (unchanged), and 11 percent spent money on new fixtures and furniture (unchanged). Fifteen percent improved or expanded facilities (unchanged) and 6 percent acquired new buildings or land for expansion (unchanged). Nineteen percent plan capital outlays in the next few months, down 1 point from March and historically very weak.

INFLATION

The net percent of owners raising average selling prices decreased 4 points from March to a net 33 percent seasonally adjusted, the lowest since March 2021. Unadjusted, 12 percent (up 1 point) reported lower average selling prices and 48 percent (down 2 points) reported higher average prices. Price hikes were most frequent in construction (59 percent higher, 7 percent lower), retail (59 percent higher, 8 percent lower), wholesale (54 percent higher, 14 percent lower), and finance (52 percent higher, 5 percent lower). Seasonally adjusted, a net 21 percent plan price hikes (down 5 points).

CREDIT MARKETS

Two percent of owners reported that all their borrowing needs were not satisfied (unchanged). Thirty percent reported all credit needs met (up 1 point) and 59 percent said they were not interested in a loan (unchanged). A net 6 percent reported their last loan was harder to get than in previous attempts (down 3 points). Four percent reported that financing was their top business problem (up 1 point). A net 26 percent of owners reported paying a higher rate on their most recent loan, unchanged from March. The average rate paid on short maturity loans was 8.5 percent, 0.7 percentage points above March and the highest since October 2007. Thirty-one percent of all owners reported borrowing on a regular basis (up 1 point

COMPENSATION AND EARNINGS

Seasonally adjusted, a net 40 percent reported raising compensation, down 2 points from March. A net 21 percent plan to raise compensation in the next three months, down 1 point from March. Nine percent cited labor costs as their top business problem, down 2 points from March. Twenty-four percent said that labor quality was their top business problem (up 1 point). Labor quality was the top business problem, with inflation in second place by 1 point. The frequency of reports of positive profit trends was a net negative 23 percent, 5 points worse than March. Among owners reporting lower profits, 29 percent blamed weaker sales, 20 percent blamed the rise in the cost of materials, 13 percent cited the usual seasonal change,10 percent cited labor costs, 9 percent cited lower prices, and 4 percent cited higher taxes or regulatory costs.

SALES AND INVENTORIES

A net negative 9 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 3 points from March. The net percent of owners expecting higher real sales volumes deteriorated 4 points to a net negative 19 percent. The net percent of owners reporting inventory increases declined 6 points to a net negative 7 percent. Not seasonally adjusted, 13 percent reported increases in stocks (unchanged) and 19 percent reported reductions (up 2 points). Eighteen percent of owners recently reported that supply chain disruptions still have a significant impact on their business (down 1 point). Another 31 percent reported a moderate impact (unchanged), and 37 percent reported a mild impact (up 2 points). A net negative 5 percent of owners viewed current inventory stocks as “too low” in April, down 6 points from March. By industry, shortages are reported most frequently in manufacturing (10 percent), agriculture (9 percent), retail (9 percent), and wholesale (8 percent). A net negative 5 percent of owners plan inventory investment in the coming months.

COMMENTARY

The economy continued to slow in the first quarter, growing at a 1.1% annual rate. Consumer spending was unexpectedly strong, which will support labor demand. Consumption added 2.5 points to the growth rate. Unfortunately, most of that spending was satisfied by inventory reductions (-2.3 points), stuff made in prior quarters and so not production and income generation in the first quarter. Residential construction posted a minor decline. Several large banks failed, blamed on poor risk management. Deposits had grown dramatically as the government poured massive Covid relief into the economy. These deposits are “hot money,” they can be withdrawn in 24 hours. The failure of Silicon Valley Bank started it all off, triggering other bank failures.

From a wider perspective, the Fed created the problem. Afraid of deflation, it kept interest rates low for years, setting an inflation target of 2%. Businesses and consumers made investment and spending decisions based on these low rates. When inflation broke out in 2020, the Fed suddenly started rapidly raising rates, from 0% to 5% while the government poured out trillions of dollars to firms and consumers (Covid relief, PPP, etc.). The stock market took off, housing prices soared along with most variable price assets. Now, the economy appears to be slowing. That will mean that the Fed will be under pressure to cut rates to stimulate the economy and support employment, more distortions in financial markets. This is not a natural cycle, it is one created by government policies. No one knows what interest rate the market would set, it’s always being manipulated.

While savers are happily receiving higher interest returns, borrowers are facing higher credit costs. And businesses borrowing to finance expansion or equipment are paying higher financing costs. If the economy sinks into a recession as many expect, owners will be whipsawed again. The President wants to be able to borrow as much money as he needs to implement all of his programs. But the cost of that debt has risen dramatically, and every Treasury bond that matures these days is replaced with one bearing a much higher interest rate. Talk of default on Treasury debt is nonsense as tax revenues are many times larger than interest cost. But as the interest bill rises, other domestic spending will be squeezed out.

A banking crisis does not appear to be a major risk. The bank failures were not due to bad loans, the usual cause. Defaults will rise as the economy weakens but hopefully not at pandemic levels. The manufacturing sector appears to be in contraction (ISM<50). The service sector is still in growth mode, but much weaker (ISM 51.2, down 3 points). Main street firms have been pessimistic for the last 18 months, with the NFIB Optimism Index at 89 (49 year average = 98). Price raising activity has slowed but remains historically high, and reports of higher labor compensation are sticky at historically high levels. This will make inflation sticky as labor costs are the major operating cost of small firms, especially in the service sector. The economy seems inclined to slow down and this will make raising prices harder and slow inflation. Maybe it’s time for the Fed to pause and let nature (markets) take its course.

Get The Full April Report (pdf)